about:blank

Stream local breaking news and original programming, live 24/7, from ABC7 Bay Area.

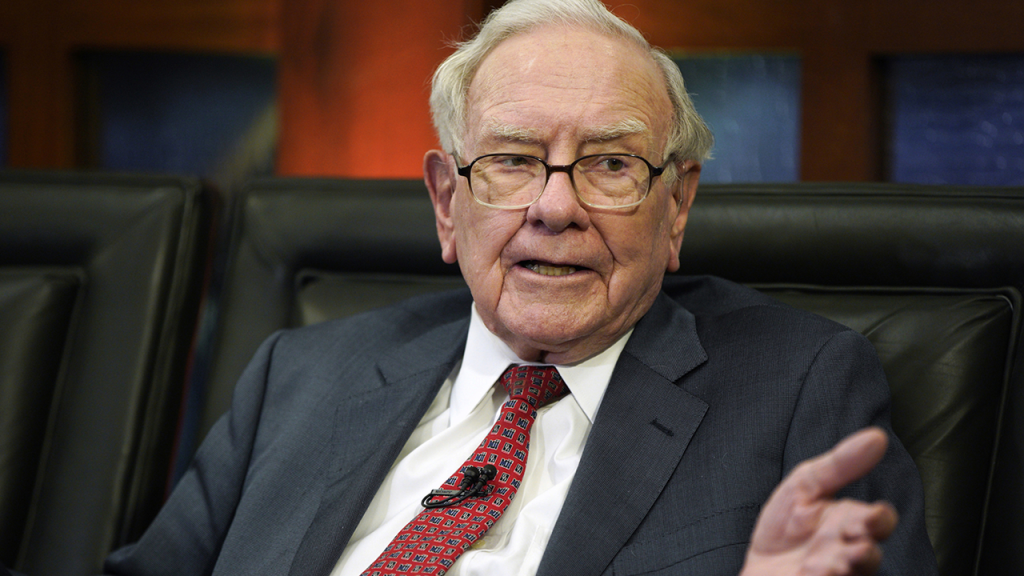

OMAHA, Neb. — Warren Buffett shocked an arena full of his shareholders Saturday by announcing that he wants to retire at the end of the year.

Buffett said he will recommend to Berkshire Hathaway’s board that Greg Abel should become CEO at the end of the year.

“I think the time has arrived where Greg should become the Chief Executive office of the company at year end,” Buffett said.

Abel has been Buffett’s designated successor for years and he already manages all of Berkshire’s non-insurance businesses. But it was always assumed that he wouldn’t take over until after Buffett’s death. Previously the 94-year-old investor has always said he had no plans to retire.

Buffett announced the news at the end of a five-hour question and answer period and didn’t take any questions about it. He said the only board members who knew this was coming were his two children, Howard and Susie Buffett. Abel, who was sitting next to Buffett on stage, had no warning.

Many investors have said they believe Abel will do a good job running Berkshire, but it remains to be seen how good he will be at investing Berkshire’s cash. Buffett also endorsed him Saturday by pledging to keep his fortune invested in the company.

“I have no intention – zero – of selling one share of Berkshire Hathaway. I will give it away eventually,” Buffett said. “The decision to keep every share is an economic decision because I think the prospects of Berkshire will be better under Greg’s management than mine.”

Thousands of investors in the Omaha arena gave Buffett a prolonged standing ovation after his announcement in recognition of his 60 years leading the company.

Buffett earlier warned that Trump’s tariffs were harmful

Earlier, Buffett warned Saturday about the dire global consequences of President Donald Trump’s tariffs while telling the thousands of investors gathered at his annual meeting that “trade should not be a weapon” but “there’s no question that trade can be an act of war.”

Buffett said Trump’s trade policies have raised the risk of global instability by angering the rest of the world.

“It’s a big mistake in my view when you have 7.5 billion people who don’t like you very well, and you have 300 million who are crowing about how they have done,” Buffett said as he addressed the topic on everyone’s mind at the start of the Berkshire Hathaway shareholders meeting.

While Buffett said it is best for trade to be balanced between countries, he doesn’t think Trump is going about it the right way with his widespread tariffs. He said the world will be safer if more countries are prosperous.

“We should be looking to trade with the rest of the world. We should do what we do best and they should do what they do best,” he said.

America has been going through revolutionary changes ever since its birth and the promise of equality for all, which wasn’t fulfilled until years later, Buffett said. But nothing that is going on today has changed his long-term optimism about the country.

“If I were being born today, I would just keep negotiating in the womb until they said, ‘You could be in the United States,'” Buffett said.

Market turmoil doesn’t create big opportunities

Buffett said he just doesn’t see many attractively priced investments that he understands these days, so Berkshire is sitting on $347.7 billion in cash, but he predicted that one day Berkshire will be “bombarded with opportunities that we will be glad we have the cash for.”

Buffett said the recent turmoil in the markets that generated headlines after Trump’s tariff announcement last month “is really nothing.” He dismissed the recent drop in the market because he’s seen three periods in the last 60 years of managing Berkshire when his company’s stock was halved. He cited when the Dow Jones industrial average went from 240 on the day he was born in 1930 down to 41 during the Great Depression as a truly significant drop in the markets. Currently the Dow Jones Industrial Average sits at $41,317.43.

“This has not been a dramatic bear market or anything of the sort,” he said.

Buffett said he hasn’t bought back any of Berkshire’s shares this year either because they don’t seem to be a bargain either.

Investor Chris Bloomstran, who is president of Semper Augustus Investments Group, told the Gabelli investment conference Friday that a financial crisis might be the best thing for Berkshire because it would create opportunities to invest at attractive prices.

“I’m sure he’s praying that the trade war gets worse. He won’t say that publicly, but Berkshire needs a crisis. I mean Berkshire thrives in crisis,” Bloomstran said.

Berkshire meeting attracts thousands

The meeting attracts some 40,000 people every year who want to hear from Buffett, including some celebrities and well-known investors. This year, Hillary Rodham Clinton also attended. Clinton was the last candidate Buffett backed publicly because he has shied away from politics and any controversial topic in recent years for fear of hurting Berkshire’s businesses.

Haibo Liu even camped out overnight outside the arena to be first in line Saturday morning. Liu said he worries that this year could be Buffett’s last meeting since he is 94, so he made it a priority to attend his second meeting.

“He has helped me a lot,” said Liu who traveled from China to attend. “I really want to express my thanks to him.”

Worries about replacing Buffett

Shareholder Linda Smith, 73, first learned about Warren Buffett and Berkshire Hathaway when she rented a room from his sister, Doris, while she was a graduate student in Washington D.C. Smith said Doris came home from an annual meeting not long after Berkshire bought See’s Candy and told her she had to buy the stock.

Smith couldn’t buy it immediately because the price of a single share was selling for about $3,400 and that was equal to her income as a grad student. But as soon as she got a job after college, she took her friend’s advice and began saving up to buy some of the stock that now sells for $809,350.

Over the years, Smith estimates she has probably attended about 20 annual meetings — often bringing a friend.

“I really like to listen to Warren Buffett — particularly this year with everything that has happened,” Smith said.

Buffett has long said he has no plans to retire because he enjoys figuring out where to invest Berkshire’s money too much. He plans to continue working until he dies or becomes incapacitated. But he remains in good health even though he does use a cane, and he shortened the meeting’s question and answer period this year by a couple of hours.

“I think even if he dies, these businesses will retain their value,” Smith said while looking around the 200,000-square-foot exhibit hall filled with booths from Berkshire companies like BNSF railroad, Geico insurance, Pilot truck stops, Duracell batteries and many others. “I anticipate my stock going down for a while but good businesses and good people will come back,” she said.

But Smith and thousands of others will definitely miss hearing Buffett’s voice of reason after he is gone. Buffett has now been leading Berkshire for 60 years.

Buffett has said that Vice Chairman Greg Abel, who already oversees all of Berkshire’s non-insurance businesses, will take over as CEO when he is gone.

Shareholders like Steven Check, who runs Check Capital Management, aren’t especially worried about succession because Abel is proven and Berkshire’s businesses largely run themselves. Buffett has said that Abel might even be a more hands-on manager than he is and get more out of Berkshire’s companies.

“I think we’ll get a more hands-on manager and that could be that a good thing,” Check said. But he said Abel also knows that those managers enjoy the freedom to run their businesses and Abel isn’t going to do anything to turn them off.